Indian exporters are now grappling with a 50% tariff on most of their goods headed to the United States. This week, President Trump announced an additional 25% tariff, on top of the 25% already in place, citing India’s continued purchase of Russian oil as the primary reason. Washington has argued that India’s reliance on Russian energy indirectly supports Moscow’s war in Ukraine.

The new tariffs will affect an estimated $55 billion worth of Indian exports, ranging from automotive parts and textiles to leather goods, garments, diamonds, precious gems, and seafood such as shrimp. Electronics and pharmaceuticals, however, are not included, two industries where the United States already benefits from India’s growing role.

India is the largest provider of generic medicines, supplying 20% of global exports by volume.

In the world of electronics, Apple, for example, has shifted a record volume of iPhone production to India, with projections of having most of U.S. iPhones manufactured in India by the end of 2026.

The United States is India’s top export destination and tariffs at this scale are expected to push prices higher for American consumers. Many Indian goods risk becoming uncompetitive in the U.S. market, raising concerns about sluggish export growth and potential job losses in India. This comes at a time when India has positioned itself as the world’s fifth-largest economy, on top of being the most populous nation, and the fastest-growing major economy.

New Delhi has condemned the move as “unjust,” calling it a blow to the U.S.–India partnership.

“These tariffs will slow down the fastest-growing major economy,” said one Indian official. “Our priority is energy security, and we will continue to purchase energy sources from whichever country best serves our needs.”

India consumes over five million barrels of oil per day, making it the third-largest oil consumer in the world after China and the United States.

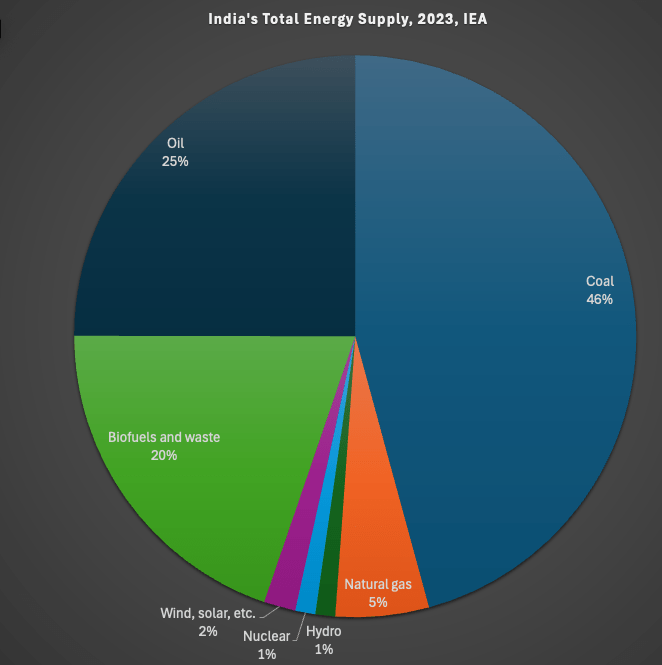

India’s top source of energy supply is still coal followed by oil and biofuels.

Source of data: IEA

Indian officials argue that New Delhi is being unfairly singled out, pointing out that China remains Russia’s largest energy customer. China continues to buy more Russian crude oil and refined products than any other country, and it is also the largest buyer of Russian pipeline gas through the Power of Siberia pipeline.

The European Union continues to import Russian gas as well, though in much smaller volumes than before. Russia’s share of EU gas supply has plummeted from about 45 percent before 2022 to around 15 to 19 percent by 2024. EU aims to eliminate Russian fossil fuel imports entirely by 2027 to 2028.

Sources:

- Reuters: https://www.reuters.com/world/india/trumps-doubling-tariffs-hits-india-damaging-ties-2025-08-27/?utm_source=chatgpt.com

- AP News: https://apnews.com/article/india-us-tariff-exports-trade-tension-48ac6d5e172df04832c75d2a57d0a860

- Global News: https://globalnews.ca/news/11352451/donald-trump-tariffs-india-50-percent/

- CNN: https://www.cnn.com/2025/08/27/economy/trump-india-tariff

- IEA: https://www.iea.org/countries/india

- AP News: https://apnews.com/article/europe-russia-gas-contracts-2027-hungary-slovakia-64a06c9062832ff92047cb736b896f78

- Fortune: https://fortune.com/asia/2025/04/25/apple-aims-build-most-iphones-us-india-end-2026/

- U.S. EIA: https://www.eia.gov/tools/faqs/faq.php?id=709&t=6&utm_source=chatgpt.com

Leave a comment